Bloomberg details:

The index of U.S. leading economic indicators increased in December more than forecast, a sign the recovery will gather steam in the new year.

The Conference Board’s gauge of the outlook for the next three to six months rose 1.0 percent after a 1.1 percent gain in November, the New York-based group said today. The December reading, the sixth consecutive monthly increase, exceeded the 0.6 percent gain in the median forecast of economists surveyed.

And the biggest driver of that growth...

- The improving job market? Nope.

- The rising equity market? Nope.

- The steep yield curve? Nope

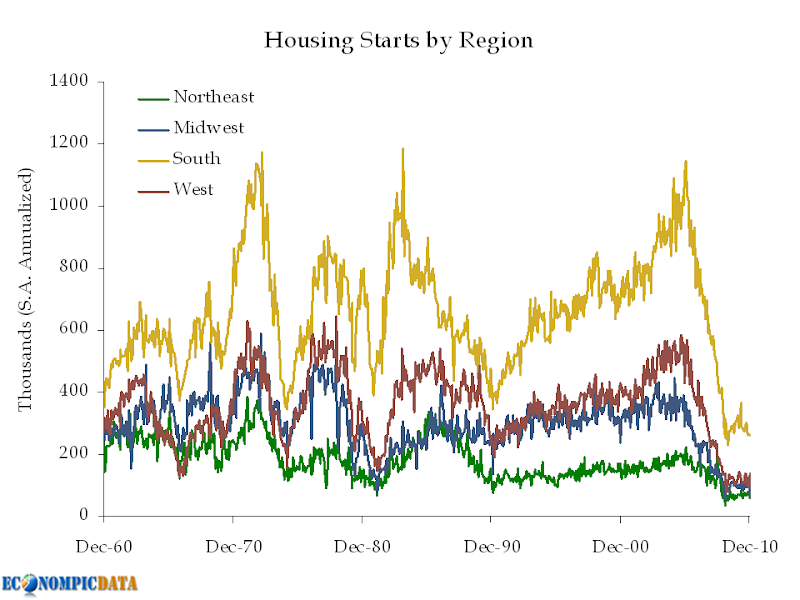

So what is it? Building permits.

The level of permits in December, excluding the recent downturn, was the

lowest figure since records began in 1960 (when the U.S. population was about 40% smaller), yet this was the biggest driver of the leading indicators.

Why?

Addition by the elimination of subtraction.

In other words, it can't get any worse than this, thus it can only get better (much more detail on this over at Calculated Risk).

Source: Conference Board